Table Of Content

If you choose to raise your deductible, make sure you have enough cash on hand to be able to pay it in case you suffer a loss and must file a claim. Some companies, like Allstate, advertise 25% savings if you bundle your home and auto insurance. For example, having all of your accounts with a single company can make your bills easier to manage, as you can go to one place to pay them. The average cost of home insurance is $1,903 per year, according to our study of all 50 states.

Can I lower my dwelling coverage to reduce my premium?

Most carriers offer discounts if you buy more than one policy or if you safeguard your home with a burglar alarm or sprinkler system. Opting for a higher deductible can also save you money, as long as it’s an amount you could cover in a disaster. State Farm came in as the cheapest widely available company on the list, with an average annual rate of $1,935. (Military insurer USAA had even less expensive policies at $1,875 per year, on average.) Meanwhile, Farmers was the most expensive, with an average annual rate of $2,415. You can schedule your personal property so that high-value items are fully insured. Scheduled personal property—also called an endorsement, floater or rider—is an optional coverage that provides more coverage for expensive items you own.

How Do I Determine How Much Homeowners Insurance I Need?

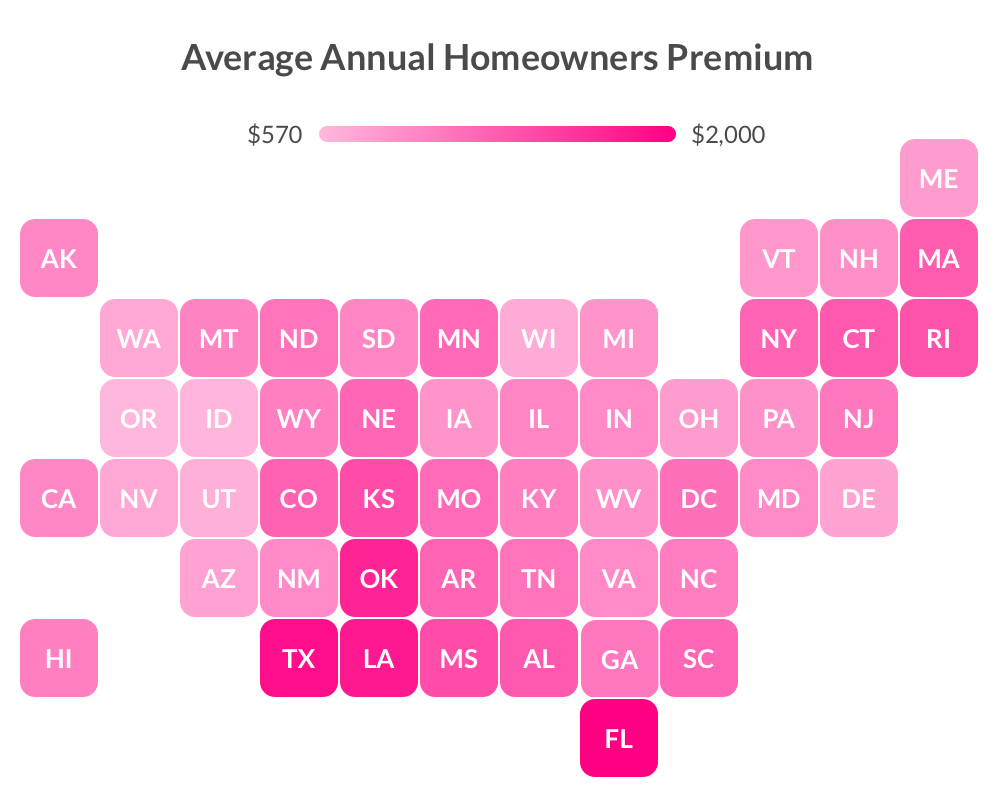

Here is a breakdown of the average annual home insurance cost by dwelling coverage amount, which should match the amount it would cost to rebuild your house. The higher your rebuilding costs, the more you will pay for homeowners insurance. The states with the least expensive average annual homeowners insurance premiums are Union Mutual, American National, Kentucky Farm Bureau, Hastings Mutual and MMG. So, how much should you budget for homeowners insurance in these locations? Below, you can see the average cost of home insurance coverage in these states and how the prices compare to the national average. Your homeowners insurance might cost more than expected if your home is older, your region is at high risk for natural disasters or you have poor credit, among other factors.

Average annual cost of homeowners insurance by dwelling coverage

In fact, homeowners with homes at elevated risk for wildfire damage may struggle to secure any insurance policy, let alone a cheap one. That said, getting familiar with the cheapest home insurance companies in California can be a good starting point if you’re looking for coverage on a budget. Even so, homeowners in California have special considerations to take into account when shopping for home insurance, like the state’s shrinking home insurance market, wildfires and earthquake coverage. Below are the average annual home insurance rates for the dwelling coverage of $600,000 and $1,000 deductible. The average homeowners insurance rate in the U.S. is $2,601 annually, or $217 monthly for $300,000 in dwelling coverage and liability and a $1,000 deductible. The cost of home insurance by state varies, however, in some cases by thousands of dollars.

How ZIP codes influence home insurance prices

Her work has been featured in numerous major media outlets, including The Washington Post and Kiplinger’s. You can choose a liability limit for home insurance, which commonly starts at $100,000, although it’s wise to have enough to cover what could be taken from you in a lawsuit. States prone to severe weather like tornadoes and hurricanes are more likely to have higher home insurance rates. The best homeowners insurance protects your biggest assets—your home and belongings.

An umbrella policy will also extend over your auto insurance policy, providing extra liability insurance in case you cause a large car accident. An insurance deductible is the amount subtracted from a claims check if you file a home insurance claim. If you’re looking to save, a higher deductible can save you money without sacrificing coverage. To find the average cost of homeowners insurance, NerdWallet calculated the median rate for 40-year-old homeowners from a variety of insurance companies in every ZIP code across the U.S. In most states, insurers can use your credit-based insurance score (similar to your FICO score) to set rates.

The cost to replace a flat roof is $3 to $11 per square foot on average or $4,000 to $16,800, depending on the size and material. Rolled asphalt is the most affordable option but has the shortest lifespan. PVC, metal, and concrete roofing are the most durable but expensive options. While some may find their insurance is too expensive, a great deal of homeowners are struggling to find any coverage, period. Here are some steps homeowners can take to make home insurance more affordable and accessible. The average increase over two years for each state is based on 27,156 total policy renewals between May 20, 2021 and May 20, 2023.

His work and expertise has been featured in MarketWatch, Real Simple, Fox Business, VentureBeat, This Old House, Investopedia, Fatherly, Lifehacker, Better Homes & Garden, Property Casualty 360, and elsewhere. But there are several actions you can take to reduce your rates and ensure you're not paying more than you should be for homeowners insurance. Homeowners insurance on a $500,000 house costs an average of $2,724 per year. But this cost can vary widely from $1,198 to $6,238 per year depending on where you live and other circumstances. Homeowners insurance on a $400,000 house costs an average of $2,222 per year. But this cost can vary widely from $999 to $5,064 per year depending on where you live and other circumstances.

Best Homeowners Insurance in Las Vegas (2024) - MarketWatch

Best Homeowners Insurance in Las Vegas ( .

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

You can lower your home insurance premium by lowering your coverage limits or pay more to get more protection. Below, you can compare your state’s average home insurance costs to others nationwide. This homeowners insurance comparison by state shows average homeowners insurance for a $300,000 house (by dwelling coverage, not market value) with a $1,000 deductible.

A typical policy deductible ranges anywhere from $500 to $2,000, but some companies offer deductible levels as high as $5,000. Homes that are larger, have outdated electrical or plumbing, or are constructed with obsolete materials will likely see higher rates since they’re either pricier to rebuild or because they face an increased risk of damage. Homes with pools, trampolines, or even dogs will also see higher home insurance rates due to the increased risk of an injury on the premises. Homeowners insurance rates are going up everywhere due to higher rebuild costs, more severe natural disasters, and other things beyond our control. Claims history is another factor insurers take into account when calculating your home insurance rate. If you've filed more than one claim in the past five years, you'll generally pay higher home insurance rates since insurers view you to be at greater risk of filing another one.

An architectural shingle roof costs $4 to $6 per square foot installed or $7,500 to $16,000 on average. Architectural shingles—also called 3D, laminate, or dimensional shingles—are thicker and last longer than 3-tab shingles. Our research determined that the average cost of home insurance in California is $1,403 per year for $300,000 in dwelling coverage. The company will offer coverage “in nearly every corner” of California, Zimmerman said.

No comments:

Post a Comment