Table Of Content

A number of homeowners across Florida told The USA TODAY Network-Florida that they had dropped – or were considering dropping – wind coverage from their insurance policies in order to save money. While it would decrease their annual policy costs, they acknowledged that it could leave them out of luck should a hurricane hit their home. Our home insurance calculator lets you get a home insurance estimate for your ZIP code at various coverage levels. You'll see the average rate and the highest and lowest from major carriers for your ZIP.

Evaluate other factors

For example, the average cost of homeowners insurance in Los Angeles is $1,485 per year, while San Jose homeowners pay $1,055 per year, on average. In California, policyholders with one recent claim pay an average of $1,390 per year — an increase of 11%. The average cost of homeowners insurance in California is $1,250 per year, or about $104 per month. The Nationwide website offers plenty of ways to manage your policy, including filing and tracking claims, paying bills and getting quotes. Aside from coverage amounts, you will also want to take a close look at the deductible, the policy type and whether your belongings are insured on an actual cash value or replacement cost value basis. These may seem like minor details but can have a major impact on what you wind up paying for your policy.

Compare Home Insurance Rates by Company

Get started by answering a few quick questions to find the cheapest homeowners insurance that matches your needs. For example, if your dog gets loose and bites someone at the park, the injured person might make a liability claim against you or sue you. Personal liability in home insurance covers settlements, judgments against you and lawyer costs—but only up to the liability limits of your policy. This covers damage or loss (through theft or destruction) of your personal belongings, such as clothes, electronics, furniture and appliances. Coverage typically is set at 50% to 70% of your dwelling coverage limit, depending on what you choose when you start your policy.

Average high-value home insurance rates by ZIP code

Our educational guides are written and fact-checked by licensed home insurance experts and reviewed by our Financial Review Council to ensure autonomy, expertise, and accuracy. Home insurance policies typically provide liability coverage starting at $100,000 but that might not be enough. Replacement cost coverage reimburses you for the cost of buying new, similar items, rather than the depreciated value of what was destroyed. Replacement cost coverage will cost you more but you’ll get a higher payout if you have a personal property claim. Raising your deductible from $1,000 to $2,500 can save you more than 12% a year on average, according to NerdWallet’s rate analysis. Make sure you have enough cash tucked away to pay it if you need to file a claim.

What are the five cheapest states for homeowners insurance?

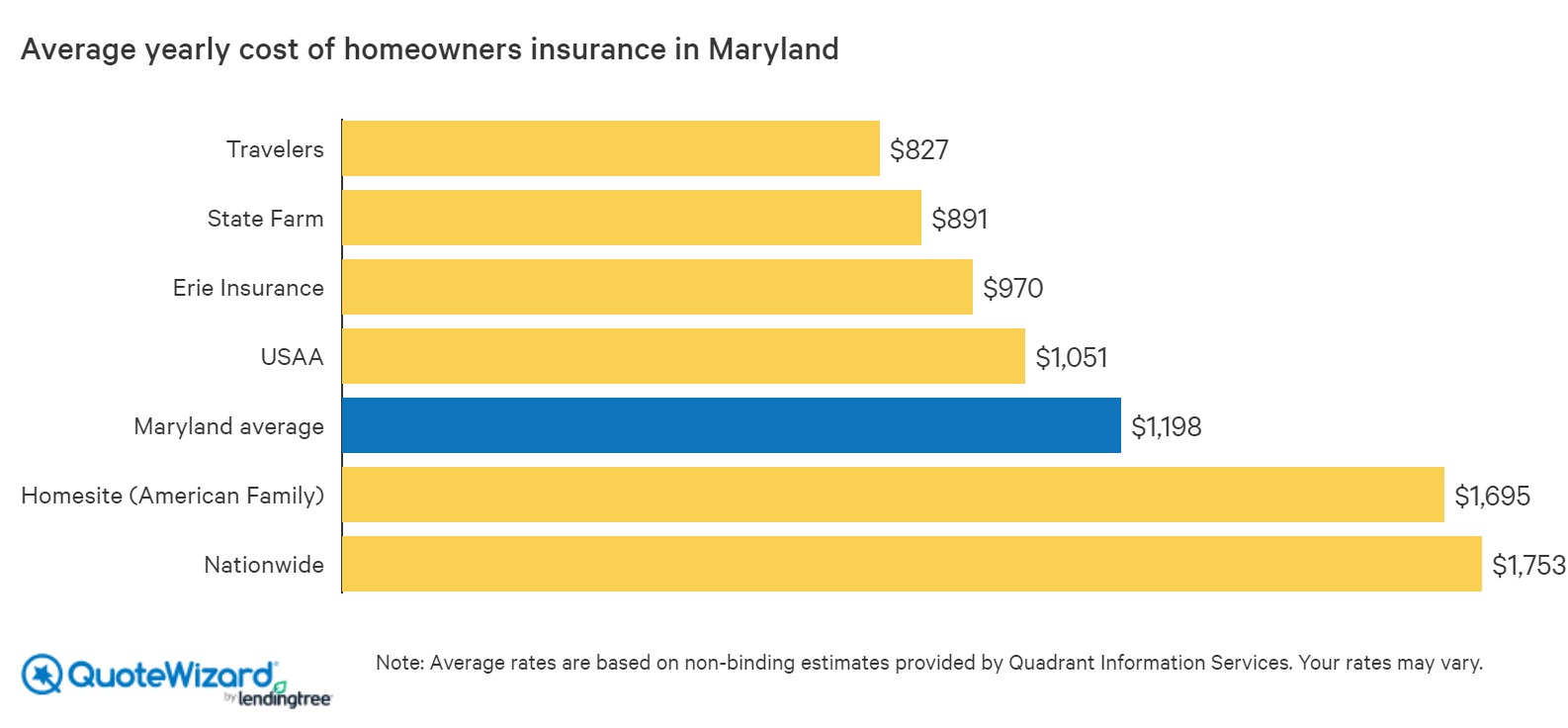

Depending on your insurance company, you may be able to divide your bill into installments, have payments taken directly out of your bank account or otherwise pay in a way that’s convenient for you. Some insurers offer tools for estimating how much their home insurance will cost. These features typically use a limited set of information, but they will at least give a sense of your potential costs. We determined the average cost of homeowner insurance using rates collected from Quadrant Information services, a company that collects insurance data and analytics. Along with the price to rebuild your home, your home’s location plays a significant role in how much you’ll need to spend on homeowners insurance. From May 20, 2022 to May 20, 2023, 94% of policyholders faced a rate increase at renewal, compared to 90% of policyholders from the previous year.

How Much Does Flood Insurance Cost? 2024 Rates - NerdWallet

How Much Does Flood Insurance Cost? 2024 Rates.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

For a homeowners insurance policy with $300,000 in dwelling coverage, Oklahoma has the highest rate at $5,858 and Hawaii has the lowest rate at $613 based on a 2023 analysis by Insurance.com. States have different rules regarding what a standard home insurance policy includes. Exclusions or separate deductibles for wind storms are common and greatly impact the average rate. Standard home insurance policies in Hawaii exclude damage from hurricanes, which is why home insurance is so cheap in Hawaii. See the homeowners insurance rates by state chart below for averages based on a coverage level of $300,000 for dwelling and liability coverage and a $1,000 deductible. To help you understand how to compare homeowners insurance quotes, which often have differing coverage limits and premiums, we’ve included two examples below.

Average cost of homeowners insurance in 2024

Top 6 Homeowners Insurance Companies in North Carolina of 2024 - MarketWatch

Top 6 Homeowners Insurance Companies in North Carolina of 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

Homeowners insurance rates can vary widely depending on where you live and your susceptibility to extreme weather damage or other risks. For example, while Company A may offer the cheapest rates for homeowners with low credit scores or homes that are riskier to insure, Company B may offer better discounts or more competitive rates for less risky properties. To get an idea of what company offers the best coverage at the cheapest rate for your situation, you'll want to compare home insurance quotes from multiple providers. The states with the cheapest average cost of homeowners insurance in 2024 are South Dakota, Hawaii, Vermont, Oregon, and New Jersey. All of these states have average home insurance premiums of under $1,000 a year for a home with $300,000 in dwelling coverage.

What Factors Influence Homeowners Insurance Quotes?

Get your baseline rate according to your dwelling coverage by referring to our cost of home insurance by dwelling amount calculation. Once you have this baseline, adjust your premium up or down by the percentage listed for your state in our cost by state table. Insurance companies consider many factors in determining your rates, including the risk profile of your state.

Average Cost of Homeowners Insurance FAQs

Although not officially ranked due to eligibility restrictions, USAA earned a score of 881/1,000 in the 2023 J.D. Power Home Insurance Study — the highest score of all the companies included. USAA also has a lower-than-average premium for home policies with $300K in dwelling coverage, according to proprietary rate data, and your belongings are automatically insured at replacement cost value. However, USAA has strict eligibility requirements and is only available to military members, veterans and their eligible family members. Its standard home insurance policies include enhanced coverage options that usually cost extra, like extended replacement cost coverage. Boutique-like coverage options and risk mitigation consulting services are why Chubb won the 2024 Bankrate Award for Best For High-Value Homes.

Extreme weather, including hurricanes, freezes and wildfires, has led to higher home insurance costs due to the number of claims these events have produced. A standard homeowners insurance policy, also known as an HO-3, covers your dwelling (house) for any problem except ones listed as exclusions in the policy. A homeowners policy also covers your personal property, such as furniture and clothes. Your dwelling coverage limit should match the amount it would cost to rebuild your house. The higher your rebuilding costs, the higher your limit and the cost of your homeowners insurance.

You may want to shop early, and end your old policy on the same date your new one starts to avoid a lapse in coverage. A coverage lapse could leave you and your home financially vulnerable and could raise your rates. Jessa Claeys is an insurance editor for Bankrate with over a decade of experience writing, editing and leading teams of content creators.

Not all insurers price their policies the same, so make sure you get quotes from multiple insurers so you can see a range of prices. Among the home insurance companies we analyzed, average rates show a cost increase of 32% from $350,000 to $500,000 in dwelling coverage and a 41% cost increase going from $500,000 to $750,000 in coverage. Even if you don’t file a claim, insurance companies often raise rates to reflect inflation. Here’s how much homeowners insurance costs on average per year by state and dwelling coverage amount. The average cost of homeowners insurance in the U.S. is $2,151 per year for $300,000 in dwelling coverage. On average, home insurance premiums differ substantially based on how much dwelling coverage is in your policy.

RCV, on the other hand, pays out what it would cost to replace the item with a new version today, minus the deductible. Some policies automatically cover personal property at actual cash value, but others require the homeowner to purchase an RCV endorsement. With three packages available (Standard, Enhanced and Premier), Farmers could be an excellent option for people purchasing their first homeowners policy. Homeowners can modify these packages further with endorsements like Eco-Rebuild, which would cover the cost of rebuilding a home following a covered loss with more environmentally friendly materials.

Natalie Todoroff is an insurance writer for Bankrate, prior to which she wrote for a popular insurance comparison shopping app. She has a Bachelor of Arts in English and has written over 800 articles about insurance throughout her career. Rate increases resulting from "actualized losses" — or losses that have already happened — are often spread out to homeowners across a state, region, or in some cases the entire country.

No comments:

Post a Comment